Muthoot Finance Personal Loan Easy to Apply and Receive Directly in your Bank Account without Agent

Muthoot finance is a recognized company in terms of loans and credit products all over India . Rather than working as a regulated banking company , the company offers only credit products and cards and loans to its customers . Also , muthoot finance is well known for its gold related lending products and low interest rate personal loan products for its customers. While customers have to apply for personal loan through agents , Muthoot finance offers personal loan to its customers without help of any agent or middlemen .

You can apply for a Personal loan of Rs 5 lakh , 10 lakh , Rs 20 lakh , Rs 50 lakh or a higher amount as per needs from Muthoot finance based on your eligibility. Without any agent , what things you can consider to apply your personal loan from Muthoot finance online is what we are going to discuss in this article.

[lwptoc]

Muthoot Finance Personal Loan

Muthoot finance personal loan offers personal loan from Rs 3 lakh to even Rs 1 crore depending on the need of the applicant . It is one of the trusted NBFCs in India to apply for a personal loan or a bank loan . The company commits to provide low interest rate personal loans to its customers without any hassle and also provides an option of applying car loan , home loan , vehicle loan , Loan against property , personal loan etc without any major formalities.

Eligibility for Muthoot finance personal Loan

Muthoot finance personal loan can be applied by any person :

- Above age of 18.

- Indian residents

- Having regular income sources like Salary or regular business income .

- Hold over securities like NSC OR Other bank bonds.

Interest on Muthoot finance personal loan application

The interest charged on Personal loan by Muthoot finance is based on the CAGR and the current credit score of the applicant . While an EMI is determined by the NBFC at the time of offering the loan provided with the rate of interest and charges charged by Muthoot finance.

Interest rate also depends on the value of collateral if any provided against the loan for repayment of Muthoot finance personal loan.

Also read : Doodh ka Business Kaise Kare Milk Business or Milk Franchise Unit kya shuru kare

Documents for Muthoot Finance Personal Loan Processing

The documents required for application of Muthoot finance personal loan documents include :

- KYC Documents

- Income proof / Salary Slip

- Address Proof

- Bank Statement of Last 3 months

- Proof of Business / Ownership of Business

How much loan can be taken from Muthoot Finance as Personal loan and Duration ?

Minimum loan from Muthoot finance as personal loan can be Rs 3 lakh and Maximum amount can be Rs 1 crore. The duration for repayment of personal loan can be a maximum of 360 months.

Foreclosure of Muthoot Finance Personal loan

Foreclosure of Muthoot finance personal loan can be done with repayment of the remaining amount of loan the repayment interest charged till the date of foreclosure. Foreclosure of muthoot finance personal loan can be done by visiting the official branch of Muthoot finance .

What if your Credit score is low to apply Muthoot Finance Personal Loan ?

If the applicant credit score is low , you can apply for Muthoot finance personal loan but at a higher interest rate . Also , in case if the credit score is less than 300 then your loan application shall get rejected . So , confirm a loan agent of Muthoot finance before application.

Also read : How to Get Finance Against your Old Property in India ?

Can you avail a Muthoot finance personal loan with an existing loan ?

Yes , with existing loan you can apply for personal loan with Muthoot finance . Except in a condition where you have applied for a personal loan with other bank .

Charges and Repayment of Muthoot finance Personal Loan 2024

The processing charges and default charges in Muthoot finance personal loan include :

- Processing charges of 1 to 2 percent of the loan amount .

- File Charges

- Agent Commissions

- GST on Service provided

- Legal document charges

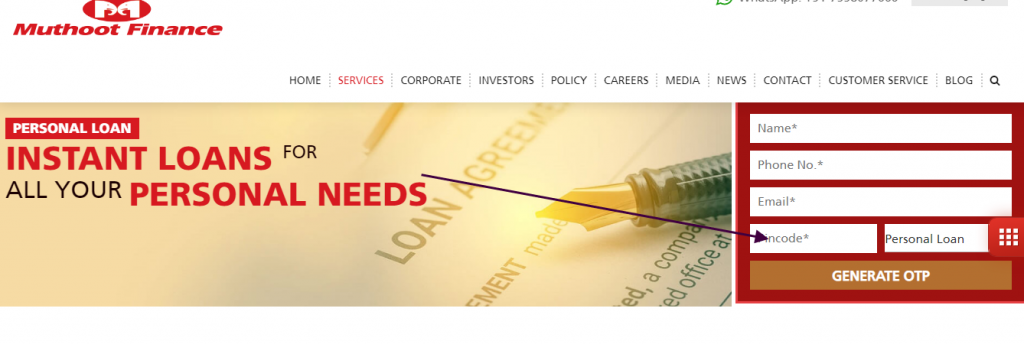

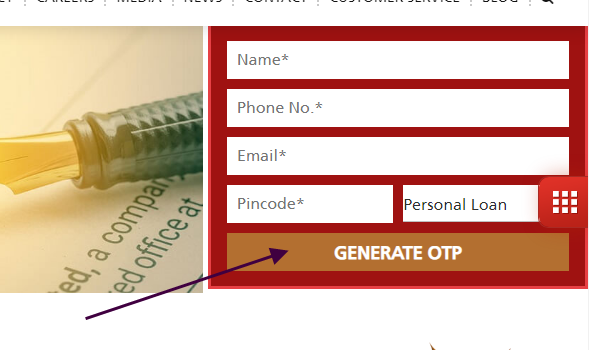

How to apply Muthoot Finance Personal Loan Online without Agent ?

To apply for personal loan from Muthoot finance personal loan online , you can follow the process :

Go to the Muthoot finance personal loan application page.

Enter your inquiry details.

Click on Submit .

What if you do no do Muthoot finance personal loan repayment ?

In case , you default in any EMI of the Muthoot finance personal loan or if you do not repay the loan , the NBFC has the right to report for misconduct and will charge heavy penalties on your account . Also , Muthoot finance recovery company shall also take up legal action against your application and repayment.

Is Muthoot finance trusted or legit to apply for a Personal loan ?

Muthoot finance is a registered NBFC under RBI guideliness , so it is a legit company to apply for personal loan .

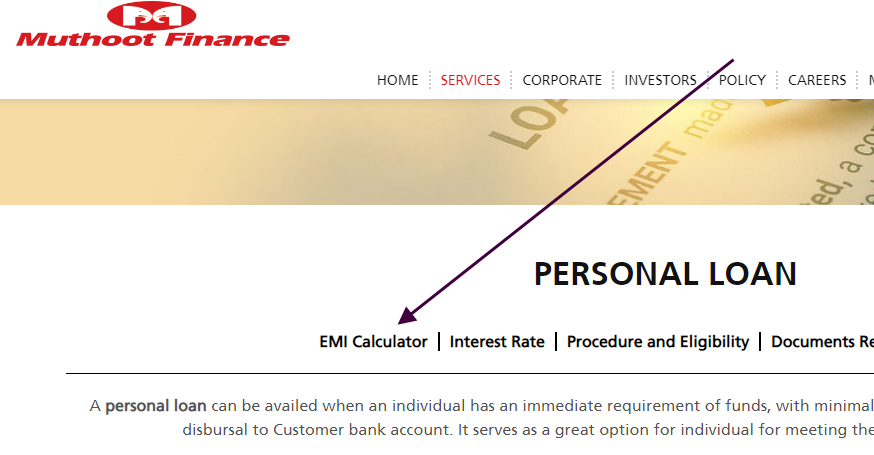

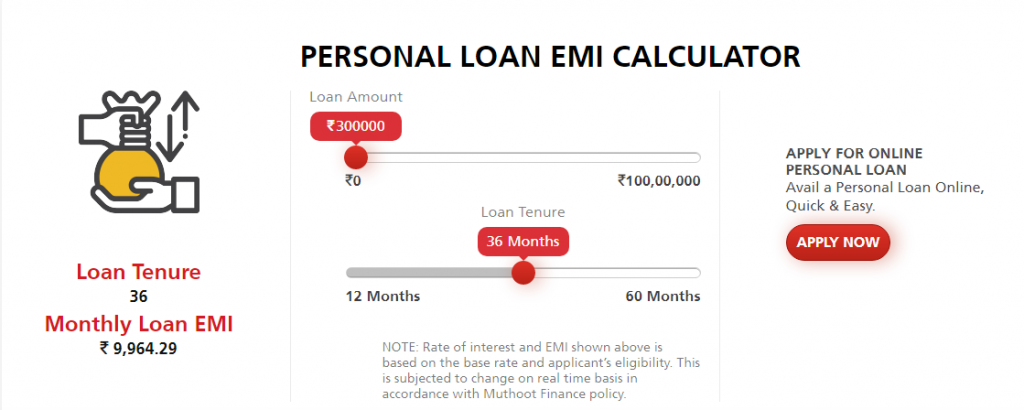

Muthoot Finance Personal Loan Calculator

To check what amount you can raise at what will be the EMI of your personal loan with Muthoot finance you can use the EMI Calculator of Muthoot finance .

Also read : Groww App से हर हफ्ते 3000 से 4000 कैसे कमाए – Groww App Real Equity Trading Profit Earning

Muthoot Finance Personal Loan Customer Support Number

If you want to apply for personal loan or want to contact to Muthoot finance personal loan customer support , you can reach out to the following contact options .

ASK AN EXPERT

CUSTOMER SUPPORT NO.:

080-35392825 (Mon-Fri, 10 AM to 6 PM)

SALES SUPPORT NO.:

8767017711 (Missed Call)

WRITE TO US:

plcustomersupport@muthootgroup.com

BRANCH TIMINGS:

Mon-Sat, 9:30 AM to 6 PM